- EQUIFAX SECURITY FREEZE HELP FOR FREE

- EQUIFAX SECURITY FREEZE HELP FULL

- EQUIFAX SECURITY FREEZE HELP DOWNLOAD

- EQUIFAX SECURITY FREEZE HELP FREE

Consumers should include their complete name, full address, Social Security number, and signature. Consumers may also send an opt-out request in writing to Equifax Information Services LLC, P.O.

EQUIFAX SECURITY FREEZE HELP FREE

Consumers that prefer not to receive such offers should visit or call toll free at 1-888-5-OPT OUT (or 1-88). To opt out of such pre-approved offers, visit Equifax maintains consumers' credit reports and provides information to certain customers, including credit card companies and lenders, so that they may offer pre-approved offers to consumers as permitted by law. Companies that wish to make pre-approved offers of credit or insurance to you.Companies that are authenticating your identity for purposes other than granting credit, or for investigating or preventing actual or potential fraud and.Companies that have a current account or relationship with you, and collection agencies acting on behalf of those to whom you owe an unpaid debt.Companies using the information in connection with the underwriting of insurance, or for employment, tenant or background screening purposes.Federal, state and local government agencies and courts in certain circumstances.Companies that provide you with a copy of your credit report or credit score, upon your request.Companies like Equifax, which provide you with access to your credit report or credit score, or monitor your credit report as part of a subscription or similar service.

Entities that may still have access to your Equifax credit report include: If you prefer to switch from one service to the other, you will first need to remove your current service and to replace it with the other.Įxceptions: Freezing or locking your Equifax credit report will not prevent access to your credit report at any other credit bureau. Please note: You cannot have both a freeze and lock on your Equifax credit report at the same time. Credit report locks allow you to lock and unlock your Equifax credit report.

EQUIFAX SECURITY FREEZE HELP FOR FREE

You can place, temporarily lift or permanently remove a freeze on your Equifax credit report for free online, by phone or by mail.Īs part of your Equifax Complete™ Family Plan, Equifax Complete™ Premier, Equifax Credit Monitor™ or Equifax Complete™ product, you can lock or unlock your Equifax credit report within your myEquifax account.

See more about exceptions below.Ī security freeze (also known as credit freeze) of your Equifax credit report is regulated by federal law. Unless you temporarily lift or permanently remove a freeze, or unlock your Equifax credit report, it can't be accessed to open new accounts (subject to certain exceptions). Both generally prevent access to your Equifax credit report to open new credit accounts. To learn more about the difference between a security freeze and a credit report lock, click here.A lock and a freeze have the same impact on your Equifax credit report, but they aren't the same thing. To place, temporarily lift or permanently remove a security freeze on your Experian or TransUnion credit reports, please contact them directly. After we receive the request and verify your identity, you will receive confirmation. Read more about acceptable documents here. If you are requesting to temporarily lift or permanently remove a security freeze via mail, you'll need to provide documents to validate your identity and address.

EQUIFAX SECURITY FREEZE HELP DOWNLOAD

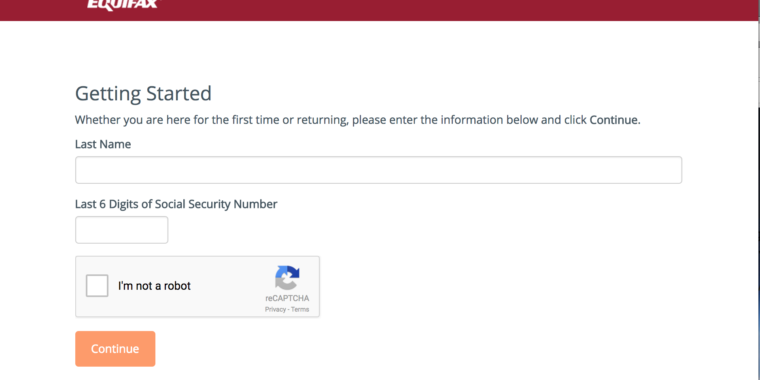

Please download this form for instructions and mailing address. You'll also have the option to receive a one-time PIN by text message or answer questions based on information in your Equifax credit report for identity verification. You'll be required to give certain information to verify your identity. You can check the status of your security freeze through your myEquifax account as well. Online, by creating a myEquifax account.You can place, temporarily lift, or permanently remove a security freeze on your Equifax credit report in several ways. Placing, lifting and removing a security freeze is free.

0 kommentar(er)

0 kommentar(er)